Calculator Whole Life Insurance Cash Value Chart

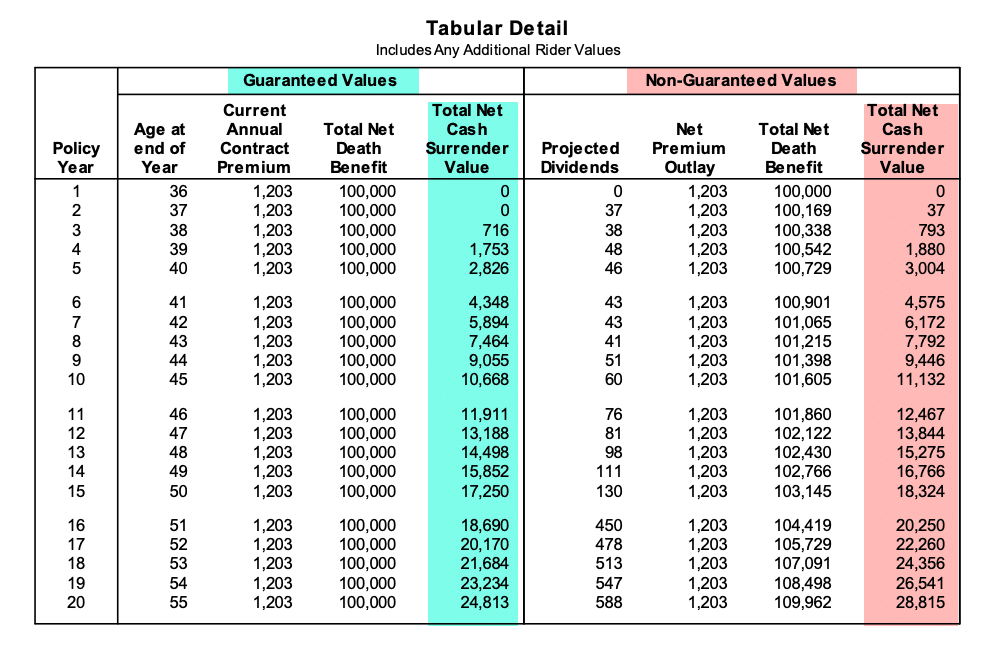

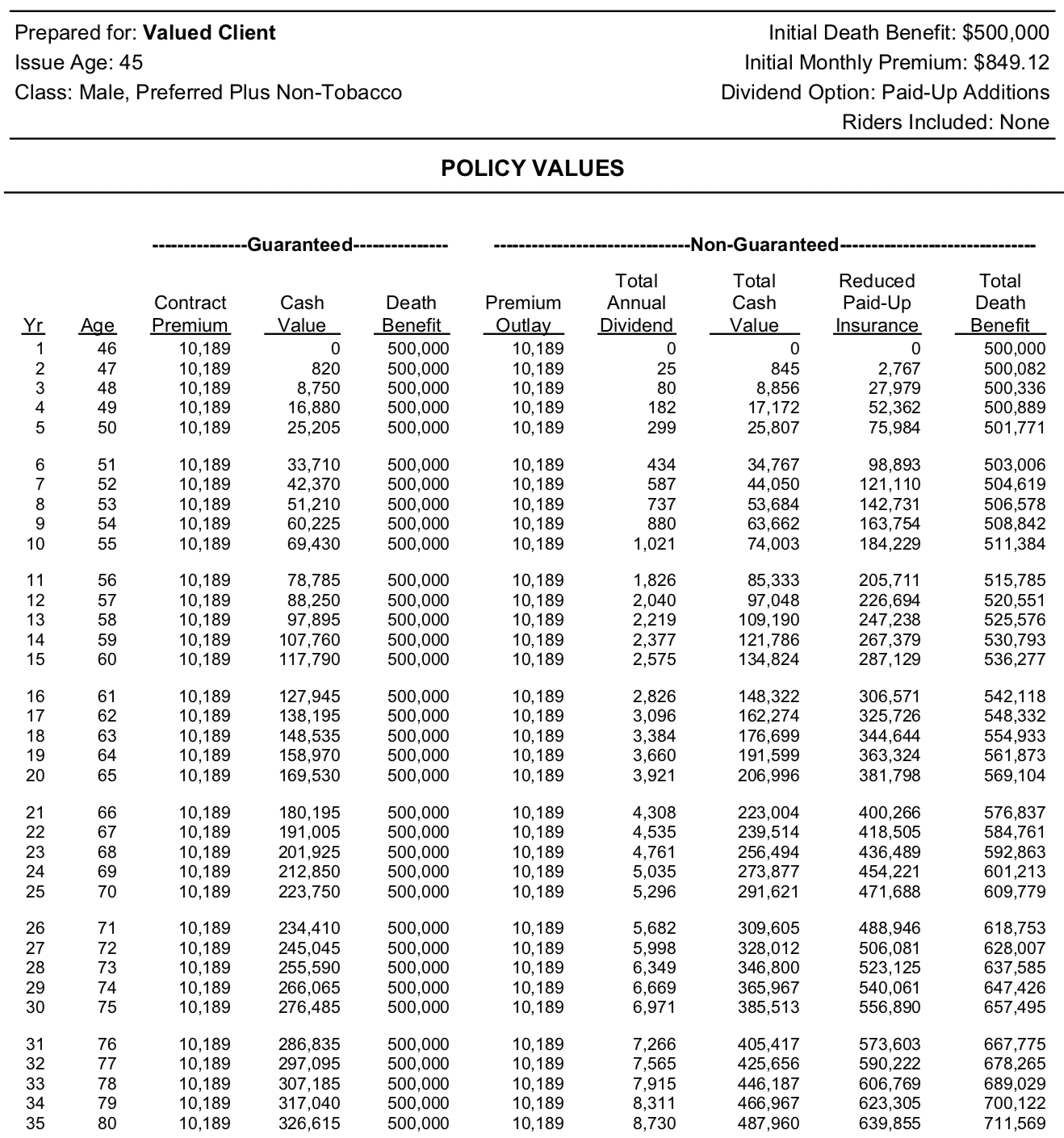

Calculator Whole Life Insurance Cash Value Chart - By contrast, the average annual rate of return on an s&p 500 is just over 10%, as of may 2024. Web ramsey added that the average whole life policy earns a 1.2% return and, if you’ve managed to build wealth on it and use that money, you’ll have to pay the insurance company interest to use it. Web cash value is a unique feature of a permanent life insurance policy that allows you to build up cash and borrow from your policy. What kind of life insurance policies have cash value? Web a whole life insurance policy guarantees a fixed rate of return on the cash value, and policyholders with mutual companies may earn additional dividends. What can you use whole life cash value for? Web how to access the cash value of your whole life policy. Web estimate the cash value of your whole life insurance policy with our online calculator. Web how is cash value in whole life policy different from cash value in indexed or variable universal life policy? Web whole life insurance. Web these charts will clearly show you how much cash value your whole life insurance has accrued. The energy giant is on track to grow free cash flow. Your insurer may allow you to borrow up to 90% of the cash value. You’ll also need to enter information like your age, gender, and coverage amount. Web a whole life insurance cost calculator can help you figure out how much insurance you’ll need. Web estimate the cash value of a whole life insurance policy with our online calculator. Web a whole life insurance policy guarantees a fixed rate of return on the cash value, and policyholders with mutual companies may earn additional dividends. Web the amount you can borrow depends on the amount of cash value in the policy and your insurer’s rules. We will be looking at three different whole life insurance cash value charts. A new york life financial professional can also assist you in finding the right whole life insurance policy for you. Web whole life features a cash value, which is held in an account that accumulates over time. Here is detailed hypothetical example of how cash value accumulates over time. We will be looking at three different whole life insurance cash value charts. Web the cash value of your policy is the accumulated amount of money that gerber life sets aside. We will be looking at three different whole life insurance cash value charts. Policy one designed for maximum death benefit, policy two is designed for accelerated cash value growth, and policy three is focused on maximum early cash value accumulation. Web ramsey added that the average whole life policy earns a 1.2% return and, if you’ve managed to build wealth. The insured can access this money before the time of their death, differing greatly from term life insurance policies. Web we explain whole life cash value charts found on policy illustrations to help you make an informed decision on whether whole life insurance is right for you. Your insurer may allow you to borrow up to 90% of the cash. That means that the longer you hold your policy, the longer the cash value builds. Web ramsey added that the average whole life policy earns a 1.2% return and, if you’ve managed to build wealth on it and use that money, you’ll have to pay the insurance company interest to use it. Variable and indexed universal life policies accumulate cash. Whole life insurance interest rates are fixed, with a minimum guaranteed rate. Web how to access the cash value of your whole life policy. What can you use whole life cash value for? (if it were purchased at age 40, age 50, age 60, and age 70.) Web the cash value of your policy is the accumulated amount of money. Web how to access the cash value of your whole life policy. Variable and indexed universal life policies accumulate cash value differently. Web whole life insurance cash value chart. Web whole life features a cash value, which is held in an account that accumulates over time. Web cash value life insurance provides both lifelong coverage and an investment account. Web your whole life insurance cash value chart will track the anticipated cash value of your policy over the years. Web the reality of whole life insurance. Web how is cash value in whole life policy different from cash value in indexed or variable universal life policy? The benefits of lifetime coverage, and over time the guaranteed cash value and. Web calculate the cost of whole life insurance. Web these charts will clearly show you how much cash value your whole life insurance has accrued. Web a whole life insurance cost calculator can help you figure out how much insurance you’ll need. Web whole life features a cash value, which is held in an account that accumulates over time. For. Web ramsey added that the average whole life policy earns a 1.2% return and, if you’ve managed to build wealth on it and use that money, you’ll have to pay the insurance company interest to use it. Web estimate the cash value of your whole life insurance policy with our online calculator. (if it were purchased at age 40, age. Web whole life insurance cash value chart. A new york life financial professional can also assist you in finding the right whole life insurance policy for you. What can you use whole life cash value for? Web if you’re considering a whole life insurance policy, you need to figure out what your needs and goals are, and then calculate how. Whole life insurance has a higher initial premium than an equal amount of term insurance, but don't confuse cost with value. Whole life insurance interest rates are fixed, with a minimum guaranteed rate. Web the reality of whole life insurance. For example, if the policy. Or $500,000 and insurance companies will calculate how much monthly premiums you have to pay for that death benefit amount. Variable and indexed universal life policies accumulate cash value differently. Web cash value life insurance provides both lifelong coverage and an investment account. Web whole life insurance. Web cash value is a unique feature of a permanent life insurance policy that allows you to build up cash and borrow from your policy. How does whole life insurance cash value build over time? Web whole life insurance cash value charts. Web a whole life insurance cost calculator can help you figure out how much insurance you’ll need. The rate at which cash accrues depends primarily on your age and the type of policy you purchase, since some prioritize higher cash growth than others. Web the cash value of your policy is the accumulated amount of money that gerber life sets aside each time you pay your premium after the initial policy years. Web how to access the cash value of your whole life policy. Web the amount you can borrow depends on the amount of cash value in the policy and your insurer’s rules.How To Calculate Premiums On A Whole Life Policy

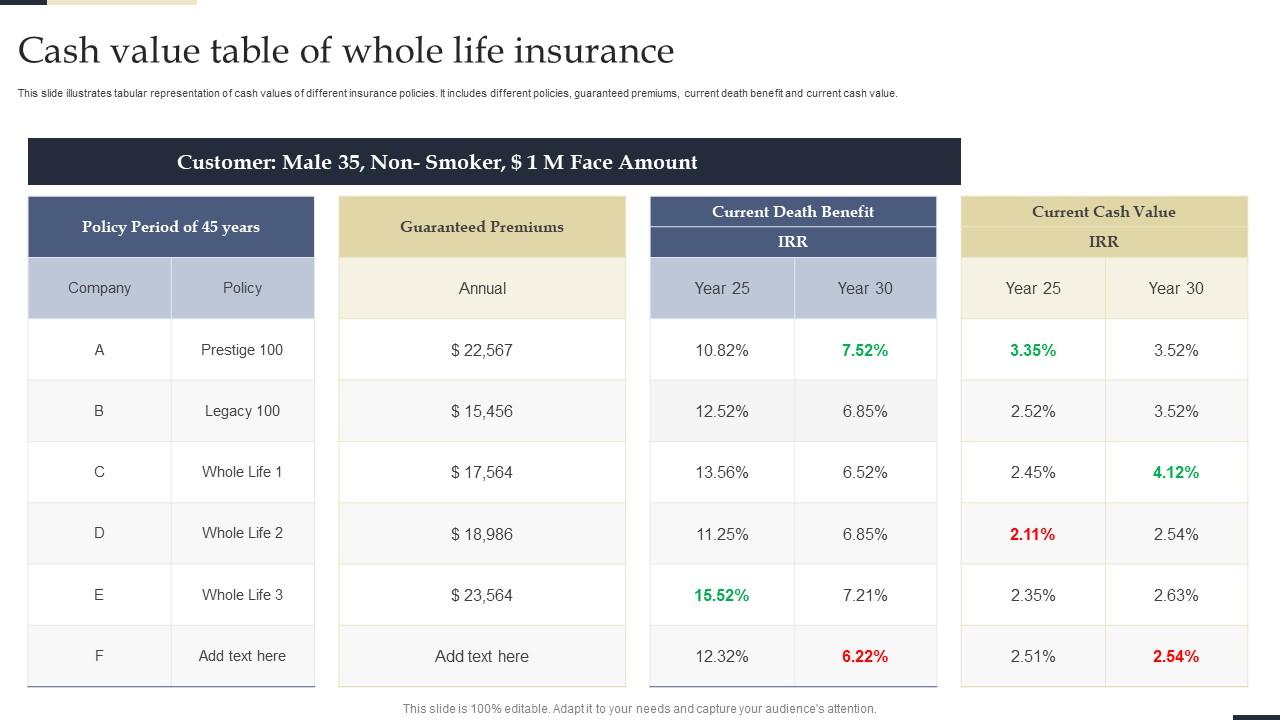

Cash Value Table Of Whole Life Insurance

Whole Life Insurance Calculator Cash Value

How Much Does Whole Life Insurance Cost? Effortless Insurance

Whole Life Long Term Cash Value • The Insurance Pro Blog

Whole Life Cash Value Explained Photos All

Calculator Whole Life Insurance Cash Value Chart

Whole Life Insurance Cash Value Chart [3 Great Examples] I&E Whole

Whole Life Insurance Cash Value Chart

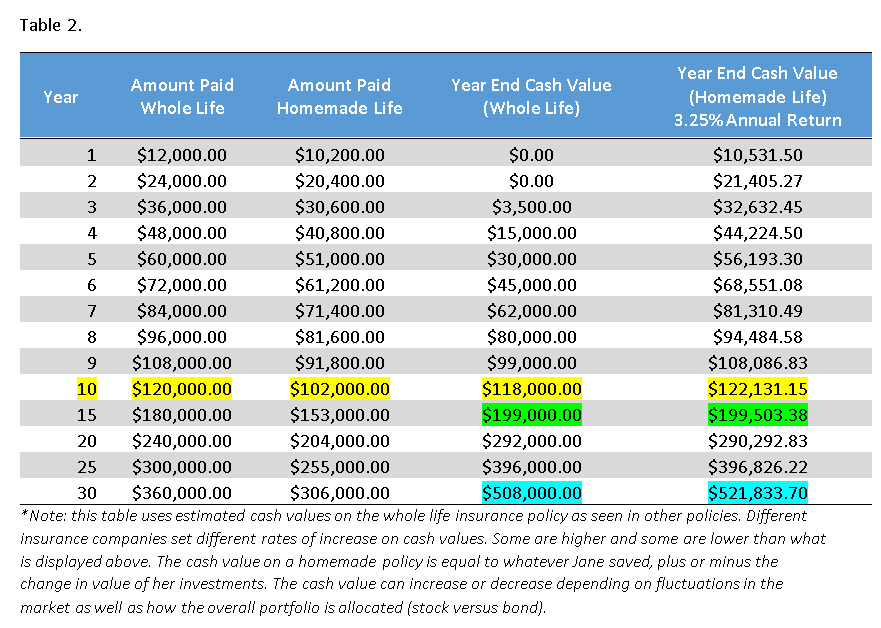

How to Create Your Own Whole Life Insurance Policy — Origin Wealth Advisers

We Will Be Looking At Three Different Whole Life Insurance Cash Value Charts.

Web Whole Life Insurance Cash Value Chart.

Web Your Whole Life Insurance Cash Value Chart Will Track The Anticipated Cash Value Of Your Policy Over The Years.

Web If You’re Considering A Whole Life Insurance Policy, You Need To Figure Out What Your Needs And Goals Are, And Then Calculate How Much Life Insurance You Need, How Much Cash Value You Will Need, And How Much It Costs You.

Related Post:

![Whole Life Insurance Cash Value Chart [3 Great Examples] I&E Whole](https://www.insuranceandestates.com/wp-content/uploads/policy-charts.jpg)