Cup With Handle Pattern Chart

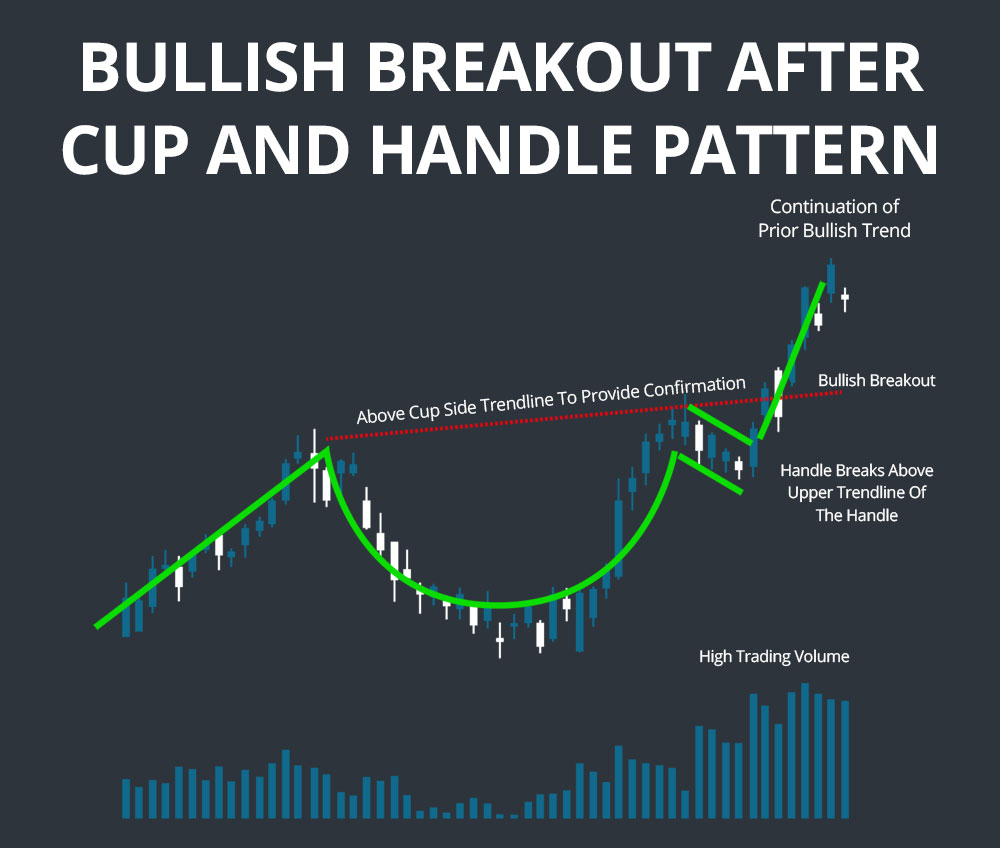

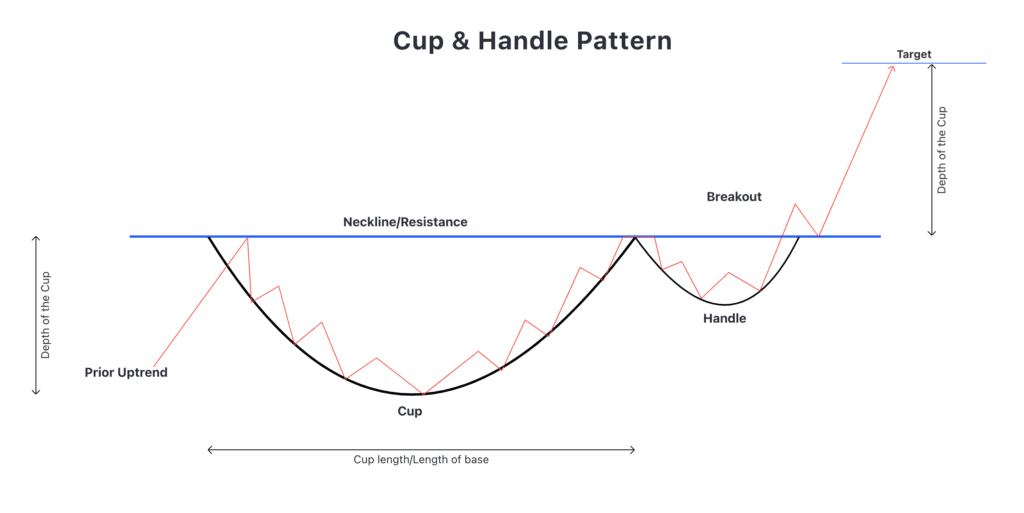

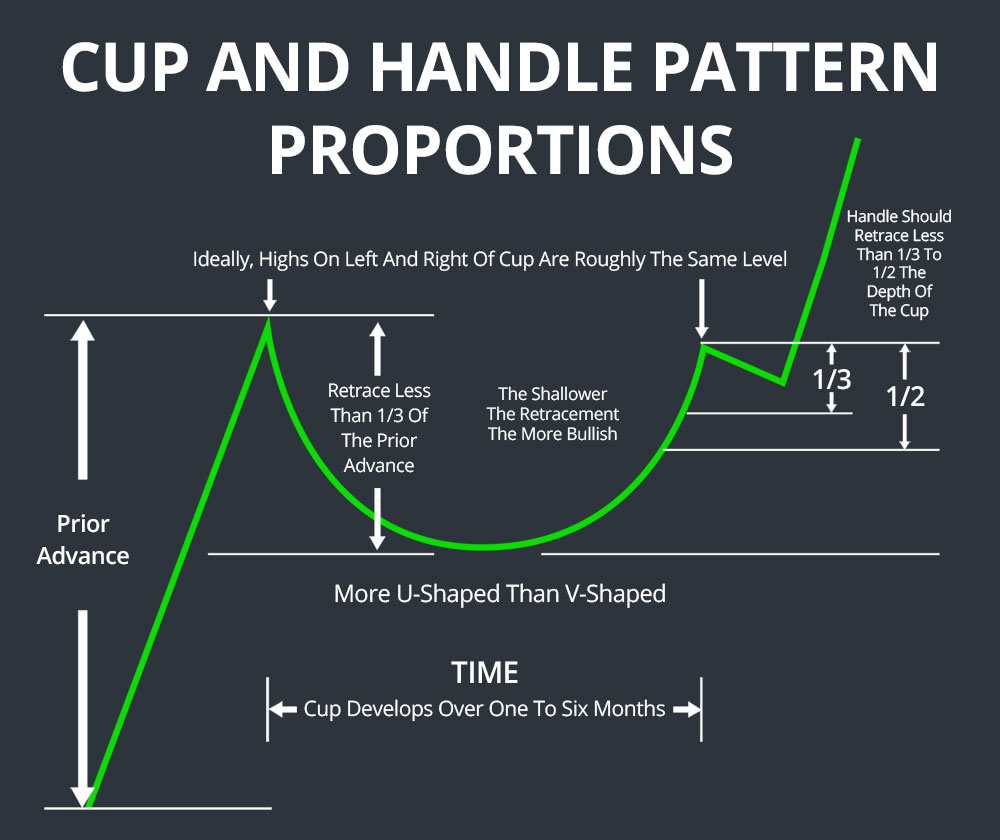

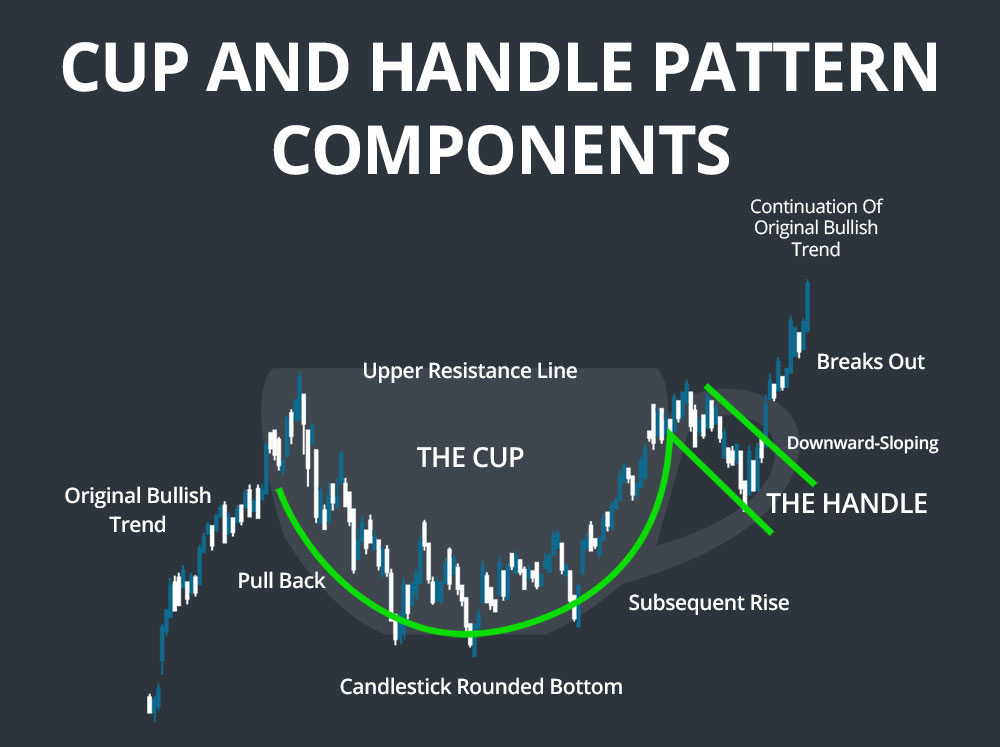

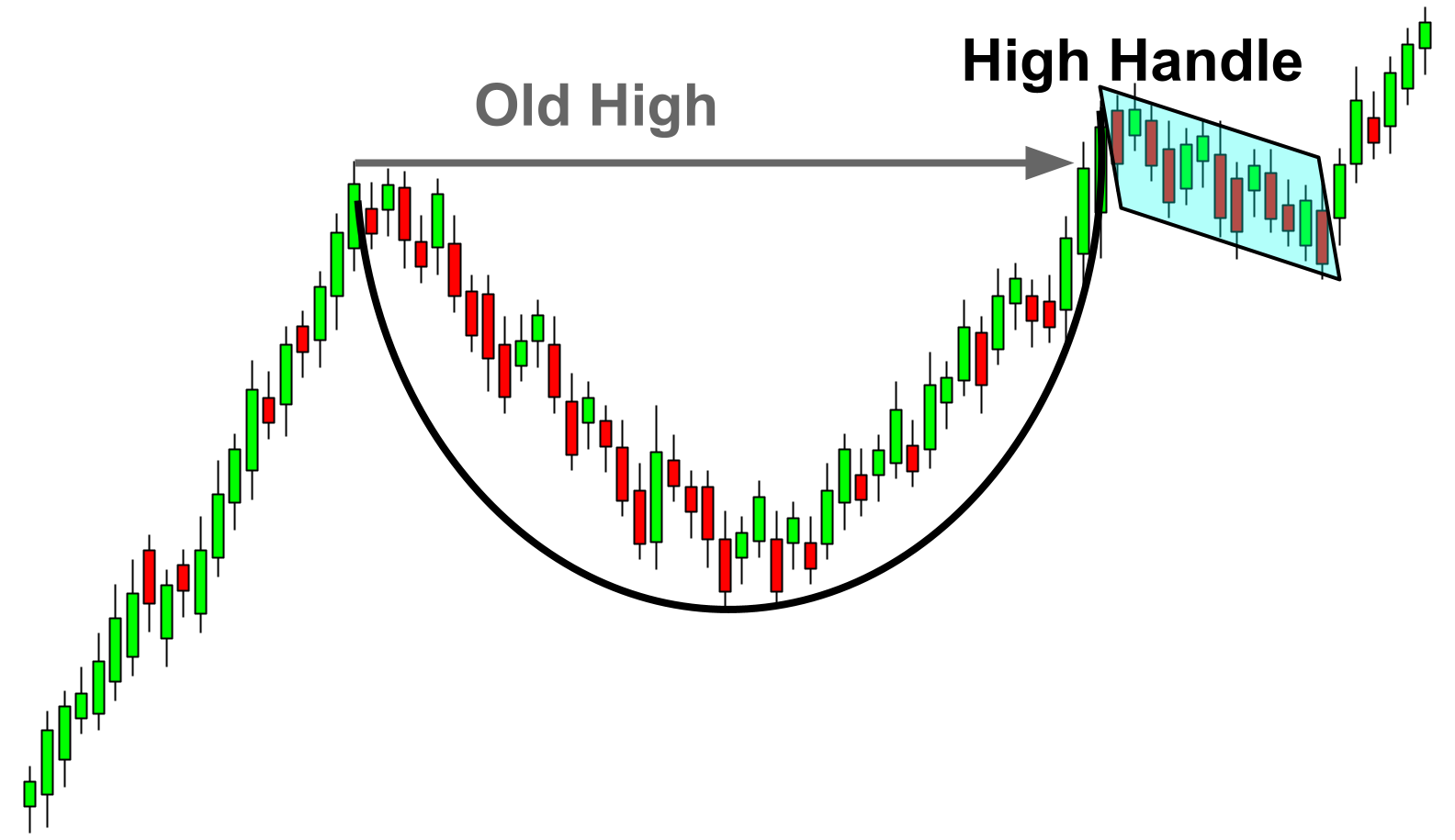

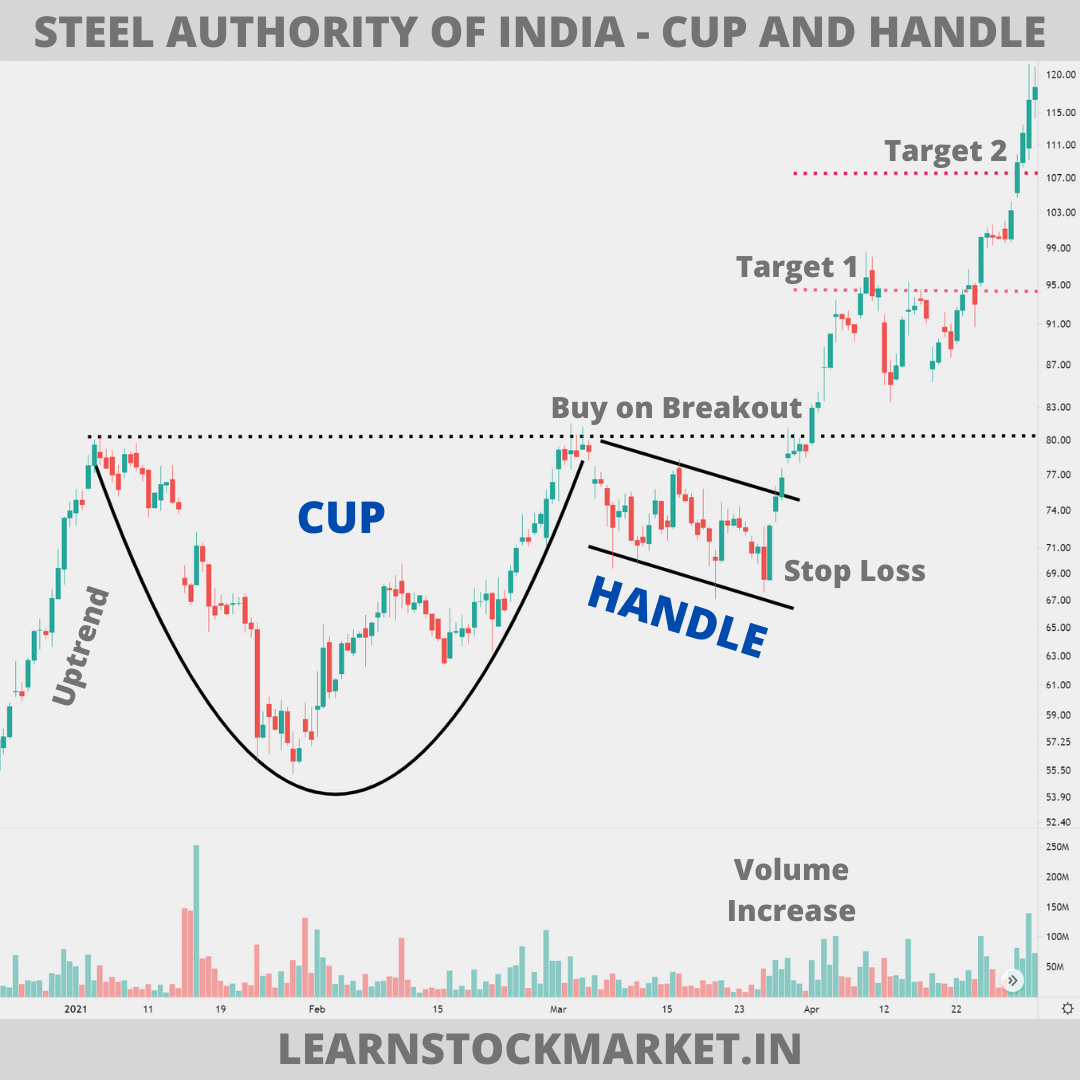

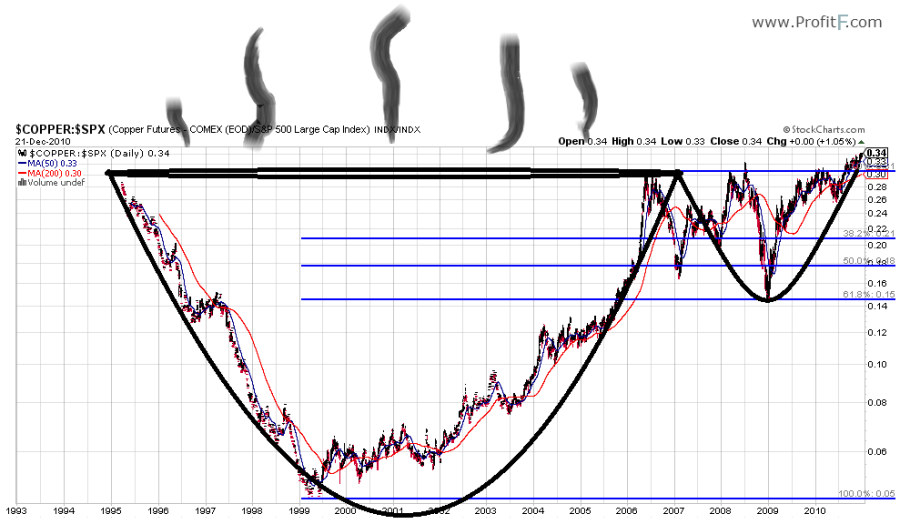

Cup With Handle Pattern Chart - Web a cup and handle is a chart pattern made by an asset’s price indicative of a future uptrend. The cup and handle chart pattern does have a few limitations. How to identify the cup and handle pattern on a chart: Web the cup and handle is one of many chart patterns that traders can use to guide their strategy. A cup and handle is both a bullish continuation and a reversal chart pattern that generally appears in an uptrend. This pattern is known for its reliability and has been widely used by traders to identify potential trend reversals and continuation opportunities. Chart patterns form when the price of an asset moves in a way that resembles a common shape, like a rectangle, flag, pennant, head and shoulders, or, like in this example, a cup and handle. Learn how to read this pattern, what it means and how to trade. Web almost every pattern has its opposite. It's the starting point for scoring runs. The easiest way to describe it is that it looks like a teacup turned upside down. Read this article for performance statistics, trading lessons, and more, written by internationally known author and trader thomas bulkowski. The high points of the cup and the handle are aligned on the same horizontal resistance line. Learn how to read this pattern, what it means and how to trade. Begin by identifying a preceding upward trend in price. Web what is a cup and handle chart pattern? Learn how it works with an example, how to identify a target. It marks a consolidation period followed by a breakout, often indicating a potential upward price movement. Web the chart pattern, cup with handle, is a continuation pattern formed by two rounded troughs, the first being deeper and wider than the second. It gets its name from the tea cup shape of the pattern. Web the ‘cup and handle’ term translates to the bar chart pattern. After the cup forms, there may be a slight downward price consolidation, creating a smaller price pattern known as the handle. Web the cup with handle chart pattern is to serious investors what the single is to a baseball fan. Web do you know how to spot a. The cup and handle chart pattern does have a few limitations. The cup presents as a bowl shape whilst the handle is depicted as a downward slanting period of consolidation. The easiest way to describe it is that it looks like a teacup turned upside down. Web a ‘cup and handle’ is a chart pattern that can help you predict. The cup presents as a bowl shape whilst the handle is depicted as a downward slanting period of consolidation. It's the starting point for scoring runs. Web the cup with handle chart pattern is to serious investors what the single is to a baseball fan. Web one of the most famous chart patterns when trading stocks is the cup with. Web a cup and handle is a bullish continuation chart pattern that marks a consolidation period followed by a breakout. Web do you know how to spot a cup and handle pattern on a chart? It is believed that after the breakdown of the handle, the price will go further in the direction of the trend by. Web the cup. A cup and handle is both a bullish continuation and a reversal chart pattern that generally appears in an uptrend. Learn how to read this pattern, what it means and how to trade. The cup and handle is no different. Web a cup and handle is a bullish continuation chart pattern that marks a consolidation period followed by a breakout.. The cup forms after an advance and looks like a bowl or rounding bottom. The cup and the handle. Web a cup and handle is a chart pattern made by an asset’s price indicative of a future uptrend. It gets its name from the tea cup shape of the pattern. How to identify the cup and handle pattern on a. The pattern starts with a rounded bottom (the cup) that resembles a “u” shape. They normally give multifold returns. Web the cup and handle pattern strategy is a bullish continuation pattern on a price chart that resembles a cup with a handle. A cup and handle is both a bullish continuation and a reversal chart pattern that generally appears in. There are two parts to the pattern: Web the chart pattern, cup with handle, is a continuation pattern formed by two rounded troughs, the first being deeper and wider than the second. It marks a consolidation period followed by a breakout, often indicating a potential upward price movement. The cup and handle is no different. Web a cup and handle. After the cup forms, there may be a slight downward price consolidation, creating a smaller price pattern known as the handle. Let's consider the market mechanics of a typical cup. But how do you recognize when a cup is forming a handle? Web it is a bullish continuation pattern that resembles a cup with a handle. It is believed that. After the cup forms, there may be a slight downward price consolidation, creating a smaller price pattern known as the handle. The high points of the cup and the handle are aligned on the same horizontal resistance line. Web originating in the stock market and popularized by william o’neil, the cup and handle pattern serves as a powerful tool for. How to identify the cup and handle pattern on a chart: Web the cup and handle pattern strategy is a bullish continuation pattern on a price chart that resembles a cup with a handle. But how do you recognize when a cup is forming a handle? Learn how it works with an example, how to identify a target. A cup and handle pattern acts as a consolidation pattern when it forms in an uptrend. Read this article for performance statistics, trading lessons, and more, written by internationally known author and trader thomas bulkowski. The cup presents as a bowl shape whilst the handle is depicted as a downward slanting period of consolidation. Web almost every pattern has its opposite. A cup and handle is both a bullish continuation and a reversal chart pattern that generally appears in an uptrend. Web it is a bullish continuation pattern that resembles a cup with a handle. The cup and handle chart pattern is considered reliable based on 900+ trades, with a 95% success rate in bull markets. And once you do, where is the buy point? It gets its name from the tea cup shape of the pattern. Web cup & handle pattern technical & fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts, divergence, growth, book vlaue, market cap, dividend yield etc. Chart patterns form when the price of an asset moves in a way that resembles a common shape, like a rectangle, flag, pennant, head and shoulders, or, like in this example, a cup and handle. It is believed that after the breakdown of the handle, the price will go further in the direction of the trend by.Cup and Handle Definition

Cup and handle chart pattern How to trade the cup and handle IG UK

Cup and Handle Patterns Comprehensive Stock Trading Guide

Cup and Handle chart pattern Best guide with 2 examples!

Cup and Handle Patterns Comprehensive Stock Trading Guide

Cup and Handle Patterns Comprehensive Stock Trading Guide

Cup and Handle Chart Pattern How To Use It in Crypto Trading Bybit Learn

Cup and Handle Pattern Meaning with Example

Trading the Cup and Handle Chart pattern

Cup And Handle Pattern Artinya

After The Cup Forms, There May Be A Slight Downward Price Consolidation, Creating A Smaller Price Pattern Known As The Handle.

From Ibm ( Ibm) In 1926 And Walmart ( Wmt) In 1980 To Nvidia In 2016 And Again In 2020, Countless Big Winners Have Made Large.

The Cup Forms After An Advance And Looks Like A Bowl Or Rounding Bottom.

Web The Chart Pattern, Cup With Handle, Is A Continuation Pattern Formed By Two Rounded Troughs, The First Being Deeper And Wider Than The Second.

Related Post:

:max_bytes(150000):strip_icc()/CupandHandleDefinition1-bbe9a2fd1e6048e380da57f40410d74a.png)