Hanging Man Candlestick Chart

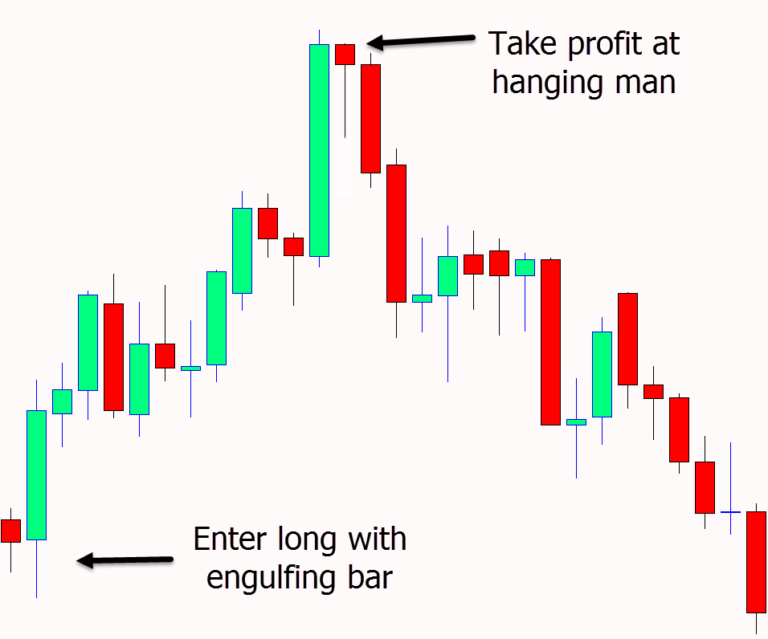

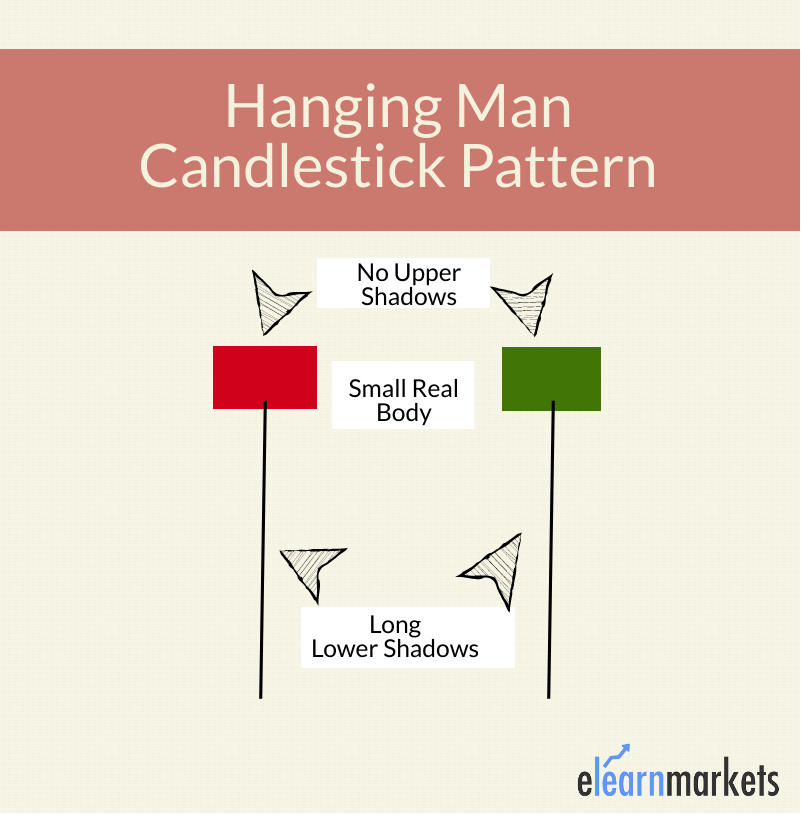

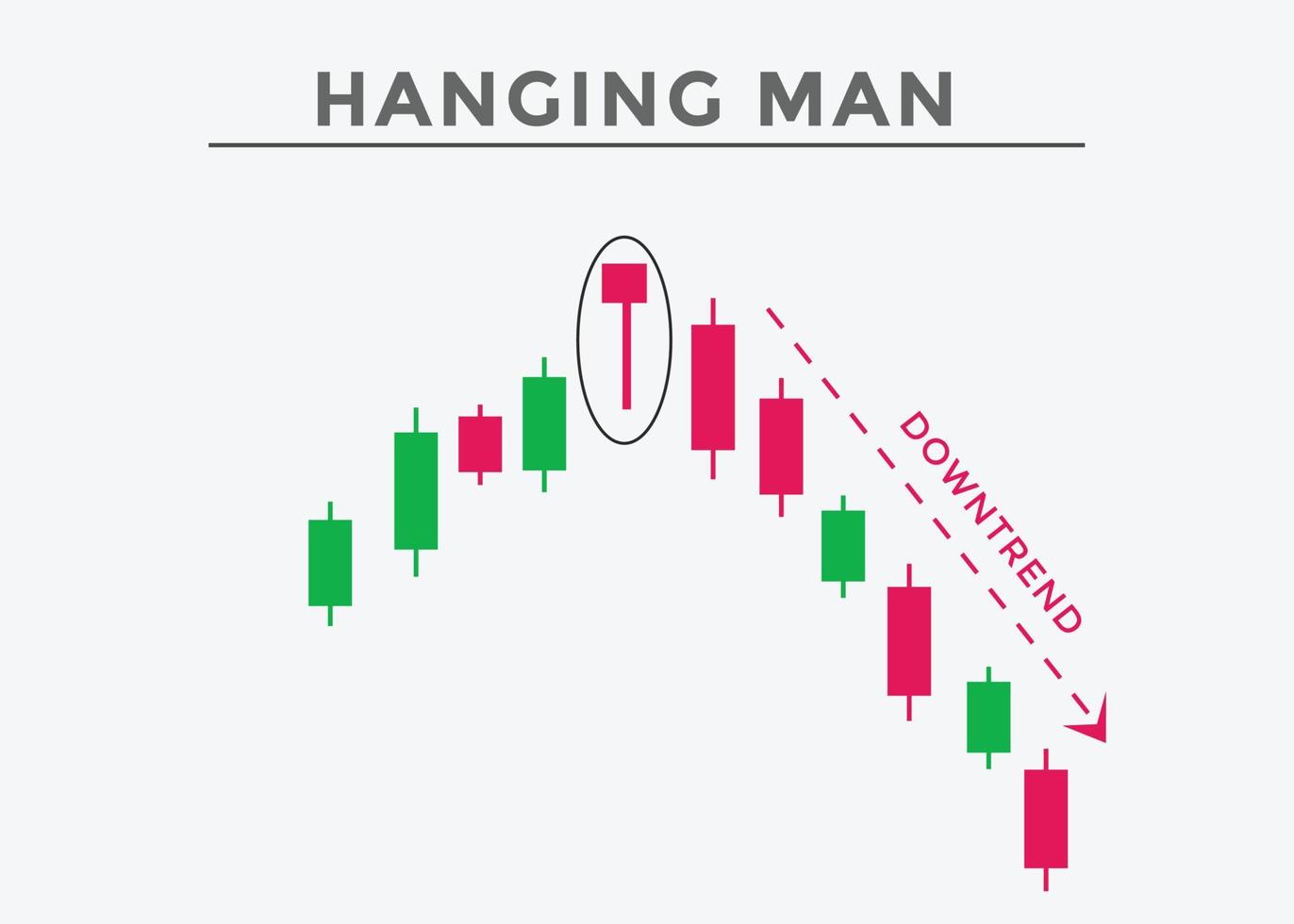

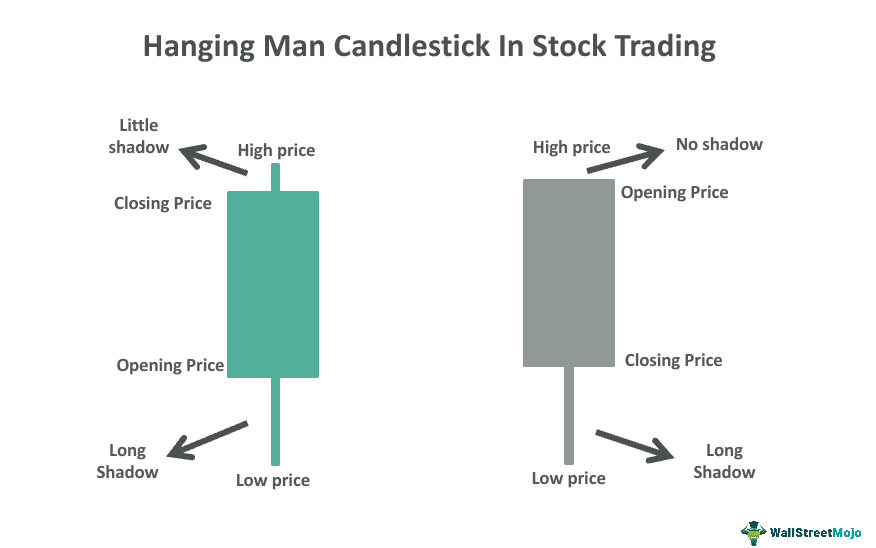

Hanging Man Candlestick Chart - If the candlestick is green or white,. Price reversals are some of the most traded setups in the financial markets. Web the hanging man pattern is a single candle formation that is easily recognizable by its distinctive shape. On the chart below, we have a eur/usd hourly chart where the price action moves upside. These patterns have a small body that can be green or red with little to no upper wick. Variants of the hanging man candlestick pattern. What is the hanging man candlestick pattern. Web like the hammer pattern, the hanging man pattern consists of a single candlestick that is called an umbrella line. Web a hanging man candlestick is a technical analysis bearish reversal pattern that indicates a potential trend reversal from an uptrend to a downtrend. Web trading the hanging man candlestick pattern is easy once a bullish trend is identified and a hanging man candle formation appears. Web what is a hanging man candlestick pattern? Identify the long term trend. Web the hanging man candlestick has clear visual cues, making it an easy pattern to spot in the charts. It forms at the top of an uptrend and has a small real body, a long lower shadow, and little to no upper shadow. The hanging man is one of the best crypto and forex candlestick patterns. Sellers were able to drive prices lower intraday but lacked the momentum to sustain the down move. Web a hanging man candlestick is typically found at the peak of an uptrend or near resistance levels. Web this article describes the hanging man candlestick, including performance statistics and rankings, written by internationally known author and trader thomas bulkowski. The candle is formed by a long lower shadow coupled with a small real. You do not want to place a trade in the. That day the stock opened and closed at practically the same price and formed a hanging man candle. It creates a significant support zone, strengthened by a high trading volume. Web like the hammer pattern, the hanging man pattern consists of a single candlestick that is called an umbrella line. The hanging man is a single candlestick pattern that appears. The first line of the bearish harami pattern being a long white candle seems to be a bullish signal. It creates a significant support zone, strengthened by a high trading volume. It resembles a man hanging from a rope, featuring a small upper body and a long lower wick, and typically appears during an uptrend. The bearish candlestick hammer, also. It also can appear after a gap up, which is perceived by traders to be a stronger bearish sign. These candlesticks look like hammers and have a smaller real body with a longer lower shadow and no upper wick. The first line of the bearish harami pattern being a long white candle seems to be a bullish signal. Web the. It signals a weak bull and strong bear presence in the market at the far end of an uptrend. How to identify the hanging man candlestick pattern. That day the stock opened and closed at practically the same price and formed a hanging man candle. The first line of the bearish harami pattern being a long white candle seems to. Web trading the hanging man candlestick pattern is easy once a bullish trend is identified and a hanging man candle formation appears. Web a more bearish candlestick following the hanging man pattern affirms the uptrend has lost momentum, and sellers are likely to push prices lower. Web the hanging man is a notable candlestick pattern in trading, signaling a possible. That day the stock opened and closed at practically the same price and formed a hanging man candle. Web this article describes the hanging man candlestick, including performance statistics and rankings, written by internationally known author and trader thomas bulkowski. It resembles a man hanging from a rope, featuring a small upper body and a long lower wick, and typically. The hanging man is one of the best crypto and forex candlestick patterns. It resembles a man hanging from a rope, featuring a small upper body and a long lower wick, and typically appears during an uptrend. There is no upper shadow and lower shadow is twice the length of its body. Web the hanging man pattern is a single. Hanging man commonly occurs as a part of bearish harami pattern. Web this candlestick chart pattern has a small real body, which means that the distance between the opening and closing price is very small. Variants of the hanging man candlestick pattern. Hanging man candlesticks form when the end of an uptrend is occurring. Web a hanging man is a. It signals a weak bull and strong bear presence in the market at the far end of an uptrend. Anytime a stock has had a significant move either up or. You do not want to place a trade in the. This pattern provides an opportunity for traders to squar their buy position and enter a short position. Web a hanging. Web trading the hanging man candlestick pattern is easy once a bullish trend is identified and a hanging man candle formation appears. Web candlestick charts are one of the most popular components of technical analysis, enabling traders to interpret price information quickly and from just a few price bars. View the chart on a longer time frame (perhaps a daily. If the candlestick is green or white,. Hanging man commonly occurs as a part of bearish harami pattern. Web the hanging man forex pattern is a singular candlestick pattern like the doji or hammer forex patterns, for example. It’s recognized for indicating a potential reversal in a bullish market, suggesting that the ongoing uptrend might be weakening. The candle is formed by a long lower shadow coupled with a small real. Web in this guide to understanding the hanging man candlestick pattern, we’ll show you what this chart looks like, explain its components, teach you how to interpret it with an example, and discuss its limitations. How to trade the hanging man candlestick pattern. The hanging man is a single candlestick pattern that appears after an uptrend. They are typically red or black on stock charts. Price reversals are some of the most traded setups in the financial markets. Web this candlestick chart pattern has a small real body, which means that the distance between the opening and closing price is very small. All one needs to do is find a market entry point, set a stop loss, and locate a profit target. Sellers were able to drive prices lower intraday but lacked the momentum to sustain the down move. An umbrella line is a long candlestick with a short real body located at the top end of the trading range, a long lower shadow, and very little or. Variants of the hanging man candlestick pattern. Web a hanging man candlestick is typically found at the peak of an uptrend or near resistance levels.How to Use Hanging Man Candlestick Pattern to Trade Trend Reversal

How to Trade the Hanging Man Candlestick ForexBoat Trading Academy

Hanging man candlestick chart pattern. Trading signal Japanese

Hanging Man Candlestick Pattern Trading Strategy

Hanging Man Candlestick Pattern Meaning, Explained, Examples

Hanging Man' Candlestick Pattern Explained

Hanging Man Candlestick Pattern (How to Trade and Examples)

Hanging Man Candlestick Pattern Trading Strategy

What Is Hanging Man Candlestick Pattern With Examples ELM

How to Use Hanging Man Candlestick Pattern to Trade Trend Reversal

Web The Hanging Man Candlestick Has Clear Visual Cues, Making It An Easy Pattern To Spot In The Charts.

Strategies To Trade The Hanging Man Candlestick Pattern.

Web Candlestick Charts Are One Of The Most Popular Components Of Technical Analysis, Enabling Traders To Interpret Price Information Quickly And From Just A Few Price Bars.

Web The Hanging Man Is A Notable Candlestick Pattern In Trading, Signaling A Possible Shift From Bullish To Bearish Market Trends.

Related Post:

:max_bytes(150000):strip_icc()/UnderstandingtheHangingManCandlestickPattern1-bcd8e15ed4d2423993f321ee99ec0152.png)